- Meridian Compass

- Posts

- The Week in FX and Crypto: December 9, 2025

The Week in FX and Crypto: December 9, 2025

30 Years of Market Structure, Distilled Weekly.

In This Issue

EUR/GBP: Hit resistance cluster (0.8804), then retraced

GBP/USD: Bearish setup delivered - dropped to 1.3179 support

BTC: Momentum failed to confirm bounce

Week Ahead: New setups and key levels

Deep Dive: When Momentum Fails to Confirm the Bounce

Market Structure Update

Last week's setups played out with precision: EUR/GBP hit its resistance target, GBP/USD dropped to flagged support, and BTC's bounce failed exactly where structure said it should.

EUR/GBP Rallied from 0.8757 to 0.8802, reaching the resistance cluster (0.8791-0.8805) before retracing. Clean rejection at the levels flagged last week.

GBP/USD Bearish reversal played out — sold off from 1.3241 to 1.3179 after the setup, hitting the 38.2% Fib support at 1.3181 that was flagged in last week's letter.

USD Index (DXY) Bullish reversal Thursday from oversold - discussed in detail in Week Ahead section below. Check out the FX in 60 video.

BTC Bounced off 80K reversed short of the upper Bolling Band and the 38.2% Fibonacci - full breakdown in Deep Dive section below.

Note: These measure market reactions from flagged levels, not trading results. Implementation varies by individual approach.

Deep Dive: When Momentum Fails to Confirm the Bounce

BTC's rally off 80k last week looked promising at first — until it wasn't. The key tell? Momentum never confirmed the move higher, and price stalled right where structure said it would.

What Happened

After bouncing from support near 80k, BTC rallied toward key resistance:

Upper Bollinger Band

38.2% Fibonacci retracement at 98,010

Price couldn't clear either level. More importantly: momentum stayed weak throughout the entire bounce.

Why It Mattered

This setup (flagged on Telegram 12/4, followed up on X with video breakdown) showed three classic signs of exhaustion:

1. Momentum Divergence

Price pushed higher, but momentum indicators stayed flat or declined. When a bounce can't generate conviction, it's rarely sustainable.

2. Failed at Confluence

The 98k zone had two technical barriers stacked on top of each other. Markets need strong momentum to push through confluence — this rally didn't have it.

3. Failed to Reach Upper Band

Price couldn't even touch the upper Bollinger Band. When a bounce stalls before reaching obvious resistance, it signals exhaustion, not strength.

The Takeaway

You don't need to predict every top. You need to recognize when a bounce is running on fumes rather than conviction. When momentum can't confirm a rally into major resistance, the path of least resistance is often back down.

Week Ahead

Coming into the holidays and end of year, price action adds another dynamic to things. Liquidity thins out, positioning gets lighter, and moves can exaggerate in both directions. Stay focused on structure and let the market come to you.

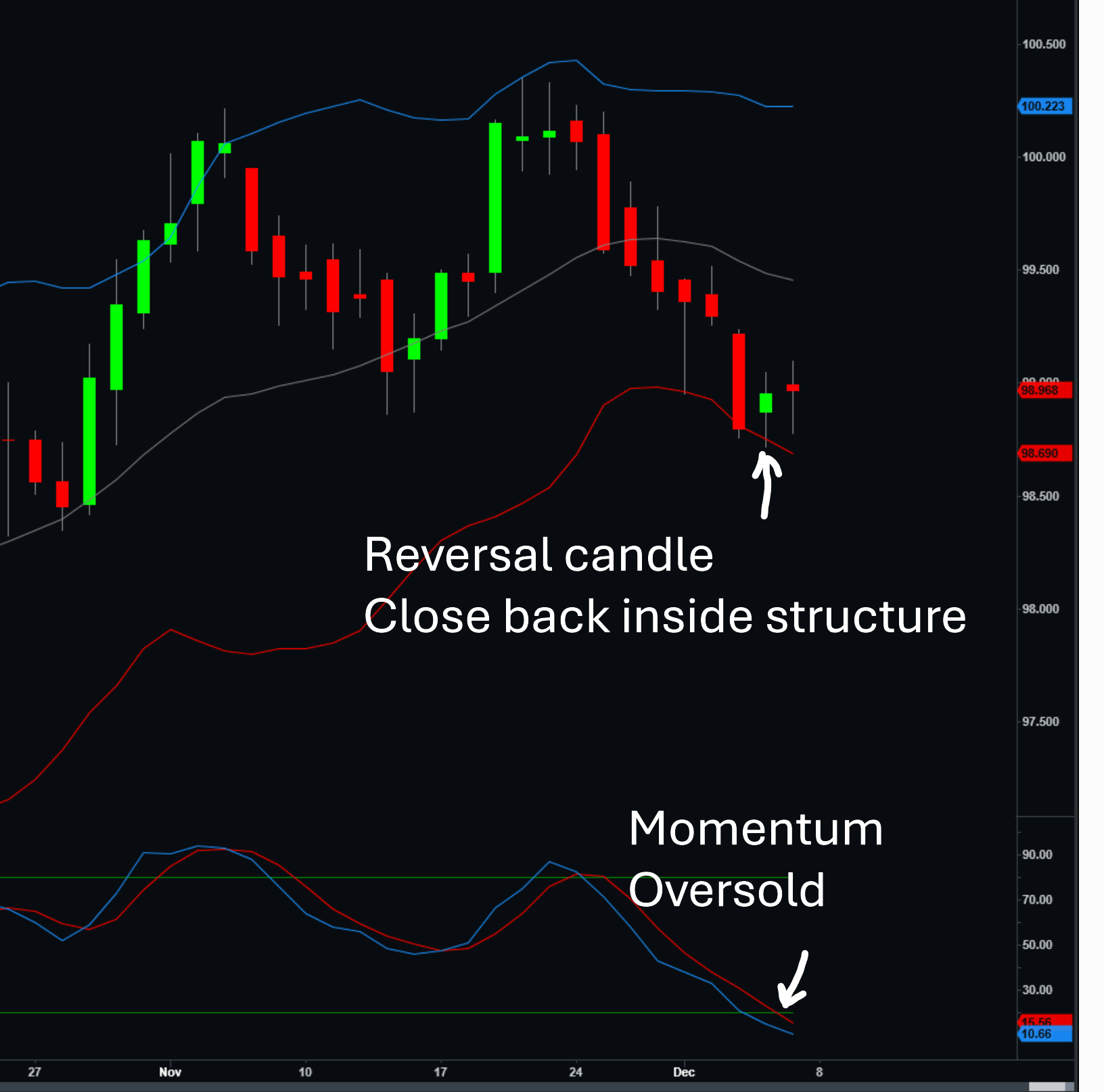

USD Index (DXY)

Bullish reversal Thursday while oversold. After closing below the lower Bollinger Band Wednesday, Thursday traded below the band, made a new low, then reversed sharply — closing above the previous day's high.

We saw an identical setup in mid-September: 6 days later, DXY was 200 points higher. 10 days after that, another 100 points higher.

If the pattern continues, the next zones to watch are:

99.44 — Mid Bollinger Band

100.23 — Upper Bollinger Band

Pattern negated on a close below 98.70.

Check out FX in 60 video “This Again?”

USD INDEX

BTC & ETH

Both range-bound to offered after last week's momentum failures.

BTC: Resistance at upper Bollinger Band + 38.2% Fib (~98K). Key downside level: 78K (38.2% of entire move). Volatility is compressed. Watch for move when vol expands. Similar set up to early November.

BTC Compressed Volatility

ETH: Bearish hidden divergence in play.

Both staying defensive until structure shifts.

FX Majors

EUR/USD, USD/CHF and GBP/USD also reflecting the USD reversal pattern.

P.S. — Want the free 10-point trade checklist? DM me "CHECKLIST" on X (@schaef45809) and I'll send it right over. Takes 60 seconds to run through before any setup.

Opening a private analysis group in Q1 2026 for real-time market structure in FX, crypto, and futures. Same framework-based approach I've used for 30 years - you'll see how I read structure as it develops.

First 25 members: $300/month locked for life. After that, price increases.

Join the waitlist: https://bit.ly/48DbkdJ

🤝 Community Growth

Thanks for reading! If this letter added value, please share it with one trader you know. You can also follow @schaef45809 on X for real-time updates

📊 What Would You Like to See More Of?

Help shape future Meridian Compass content—let me know what's most valuable. Select one of the topics below:

What Would You Like To See More Of? |

If you have other topics you’d like to suggest for future issues, please email me directly at [email protected]

Questions? Feedback? Reply to this email—I read every response.

MERIDIAN COMPASS • Institutional FX Intelligence

Meridian Compass is brought to you by Mark Schaefer, a quantitative portfolio manager with over 30 years experience developing and trading systematic strategies in global futures and FX at major banks and hedge funds.

IMPORTANT DISCLAIMER