- Meridian Compass

- Posts

- The week in FX: July 22, 2025

The week in FX: July 22, 2025

Real-World Trading Insight. No Hype, Just Edge.

Last week's newsletter analysis played out as expected, delivering 542 points across three calls:

EUR/AUD: Tested 1.7765 support → Market bounced +181 pips

GBP/AUD: Respected channel structure → +256 pip bounce

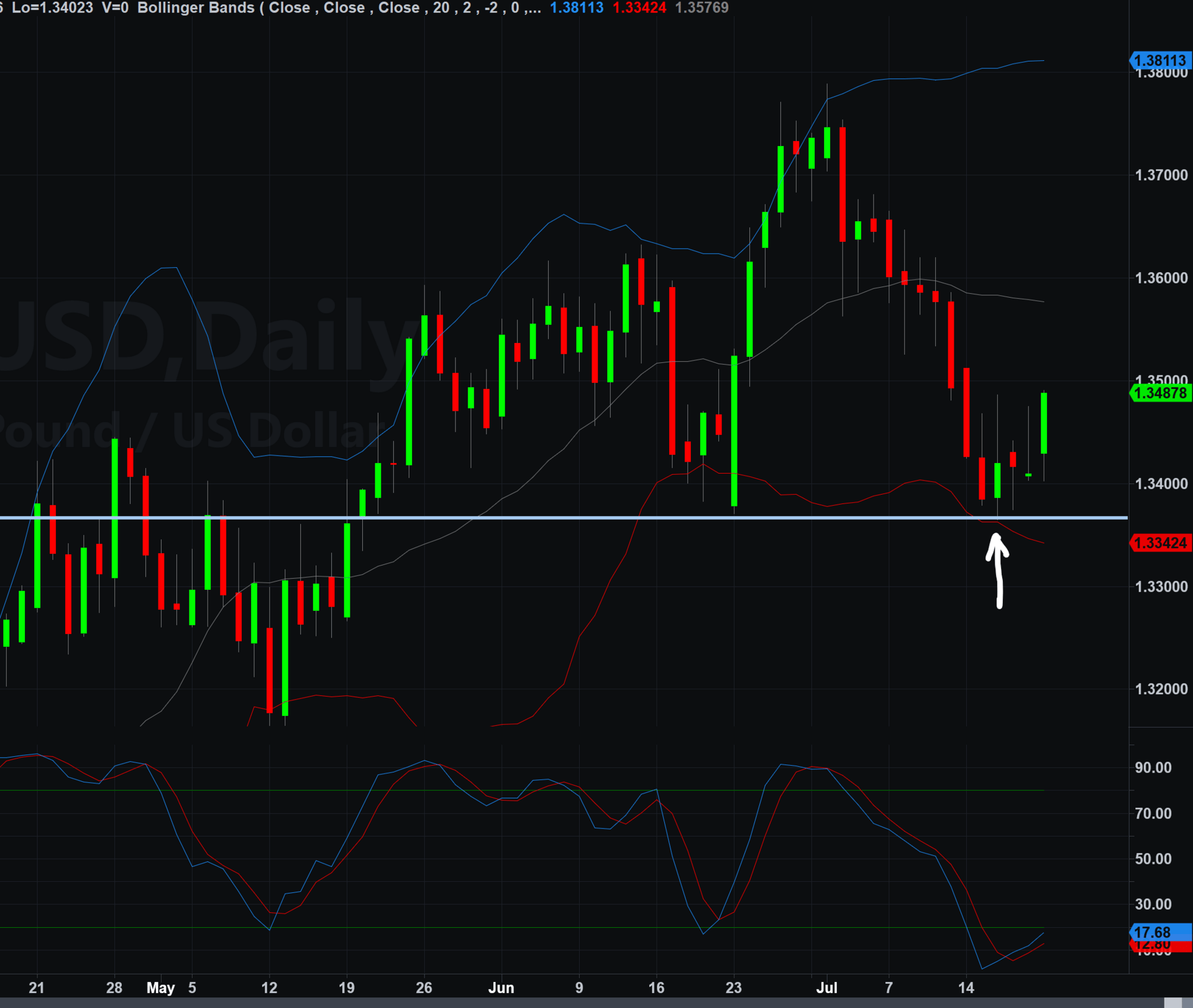

GBP/USD: Reached 1.3370 level → Clean +105 pip response

While markets got whipsawed by headlines, market structure delivered results.

USD: What Markets Are Telling Us

Fed Governor Waller's dovish speech Wednesday triggered headline volatility, but positioning analysis reveals more interesting dynamics underneath.

USD Dynamics:

Technical exhaustion: USD Index printed bearish reversal after 2 weeks of strength

Futures positioning: USD shorts increased during the USD rally

Trend-following strategies: Still holding shorts from higher levels

Momentum strategies: Flipped to USD longs after recent price action

This creates an interesting setup where different trading approaches—momentum strategies vs. trend-following strategies—are positioned opposite each other.

Week Ahead: What to Watch

GBP/USD 1.3365/70: Pivotal level - double bottom with momentum stretched

Cross pairs: EUR/AUD and GBP/AUD technical structures holding well

DXY momentum: Watch for any strength above recent highs as signal of extended USD squeeze

FX volatility: Regime transitions typically accompanied by vol expansion - watch for breakouts

Reading Market Structure

Having delivered +25% returns in both 2008 and 2009 while scaling assets from $50M to $330M in FX at Eagle Trading Systems during the financial crisis, I've learned that opportunities come from systematic market structure analysis.

Institutional traders classify markets into five regimes: trending, ranging, transitional, event-driven, and sentiment extremes. Each regime requires different positioning approaches and risk parameters. Currently we're seeing crosses mostly range-bound within established channels, while USD is in a transitional regime where momentum and trend followers diverge.

These levels represent the confluence of technical structure, momentum dynamics, and positioning analysis that institutional traders monitor.

Institutional Market Framework

1. Positioning Assessment: Who's long/short and why?

2. Technical Confluence: Multiple timeframe structure alignment

3. Risk Management: Clear invalidation levels and stop criteria

4. Policy Context: Fed communications and policy adjustments

Meridian Compass Pro Coming Soon

Several readers asked about learning my approach to reading markets.

Complete institutional training from a PM with 30+ years managing institutional assets:

Regime identification: How to classify and trade each of the 5 market regimes

Risk frameworks: Institutional approaches to stops, targets, and trailing profits/stops

Implementation strategies: Different trading approaches for trending vs ranging vs transitional markets

Risk awareness: News cycles, correlation risks, and potential market hiccups that derail positions

Want to Learn the Complete Approach?

Learn the institutional risk management and regime analysis that delivered crisis-tested performance.

Reply "PRO" for early access details.

Questions? Feedback? Reply to this email—I read every response.

Meridian Compass is brought to you by Mark Schaefer, a portfolio manager with 30+ years experience managing institutional FX and global futures strategies at Eagle Trading Systems, Barclays Bank, ABN Amro, and Centiva Capital, including delivering +25% returns in both 2008 and 2009 during the financial crisis.

IMPORTANT DISCLAIMER